Property is a cornerstone of any serious investor’s portfolio who wants to build wealth. But if you live in Switzerland, what options do you have available?

Switzerland is commonly recognised as one of the wealthiest countries in the world, with a GDP per capita of $83,832 according to the World Population Review and a population that has the highest average income across the globe.

However Zurich is considered one of the most expensive cities in the world. The average Swiss property in Zurich costs around CHF 2,090,000. Moving further out, cities such as Geneva (CHF 1.94 million) and Lausanne (CHF 1.49 million) remain fairly costly – demonstrating just how expensive the wider Swiss market is.

Despite these property prices, Switzerland still delivers a weak rental yield. With yields generally hitting around 2% – 4% in Switzerland.

Alternatively the UK property is regularly considered one of the most attractive investment markets because of the stability and returns it can provide. In fact, during 2018, European investment into the UK made up 40% of the market, putting the UK firmly at the top of many European’s wish lists for 2019.

UK Market vs Swiss Market

UK housing market is conducive to the landlord looking to invest. Low interest rates. Housing supply not been keeping up with demand. England must build 340,000 homes per year until 2031 to meet demand – a figure significantly higher than government’s current estimates. 1.8 million households on English local authority housing registers and significant levels of overcrowding in the private and social housing stock. An estimated 8.4 million people in England are living in an unaffordable, insecure or unsuitable home, according to the National Housing Federation.

The rental market continues to reach new heights and remains on course to make up a quarter of the wider market by 2021. Driven by all new levels of demand, rental prices are also on the rise – the Royal Institution of Chartered Surveyors (RICS) predicts a general increase of rents by 15% over the next five years.

In terms of property prices, JLL predict a bright start for the entire market as long as a Brexit deal is reached, with prices gaining traction post-2021. Providing a successful deal with the EU, JLL are forecasting house prices to grow by 11.4% in the next four years.

In Switzerland the Swiss banks are moving to tighten lending conditions on people buying property as an investment rather than as a residence. For those purely investing in property, 25% of the value of the loan must be given as a down payment before they can even get a mortgage. On top of this, a third of the loan has to be repaid within ten years. Driven by the threat of rising property prices and following on from warning shots by Swiss financial regulators, it’s clear once again that the UK market poses much less of a challenge for investors.

UK Property Prices vs Swiss Property Prices

Directly comparing property in the UK and Switzerland brings up some interesting figures. Due to its reduced size, Switzerland has a much lower range of assets available compared to the UK, meaning a much more competitive market that has driven property prices much higher.

The average UK property price in some of the bigger regional cities sits at around £200,000 (Birmingham), £169,000 (Liverpool) and £189,000 (Manchester). These prices alone make it easy to understand why Swiss investors often look overseas for their investments, particularly when favourable foreign exchange rates can often mean better value within more affordable markets.

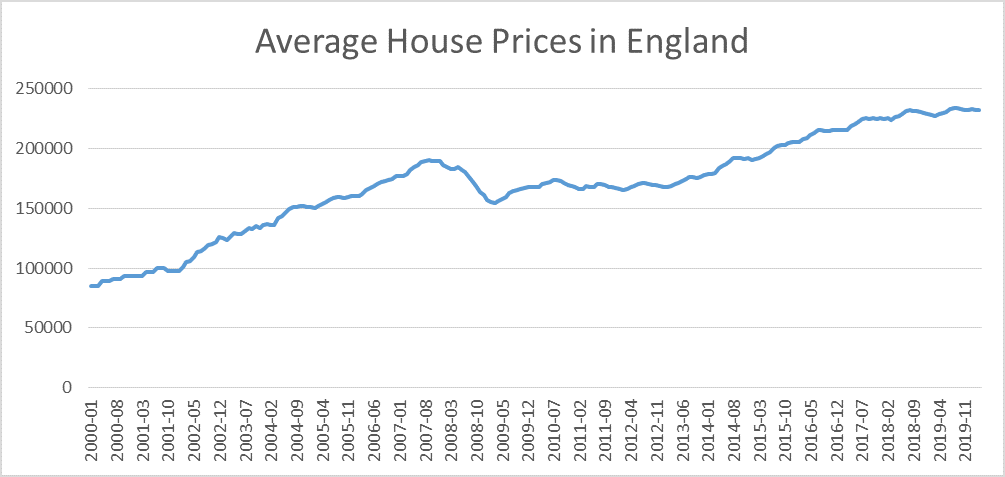

Growth has also been much stronger in the UK between 2000 and 2016, despite Switzerland seeing substantial price increases. Swiss property rose by around 80.5% in those 16 years, while the UK saw price rises of 144%. However, the Swiss markets relative lack of affordability and the rise of the Swiss currency against the Euro means Swiss real estate has seen much less demand from foreign investors.

Comparing Homeownership in the UK and Switzerland

Homeownership in Switzerland is low (around 60% of Swiss residents rent their property), mostly driven by limited housing stock, rising prices and restrictions that delay property purchases.

In the UK it is a very different story. Renters only make up around 25% of the housing market but it’s a figure that is rising fast. As Generation Rent comes into play – driven by affordability challenges and a priority on flexibility – which is seeing homeownership levels in the UK drop. It’s expected by 2039, renters will outnumber homeowners in the UK market, demonstrating the pivot to a more ‘European’ approach to home life.

Conclusion

When all of the above is taken into account it’s easier to imagine why such a large majority of European investors, particularly from Switzerland, are looking to the UK for their next investment. Business links between Switzerland and the UK remain strong – bilateral trade is worth almost £31.7 billion a year – and foreign exchange rates mean Swiss investors can leverage their income against a weakened Sterling, presenting the opportunity for incredible value.